Leyla Baghirzade Leyla Baghirzade

Fintech Entrepreneur and Board Member of Blockchain, Azerbaijan

Leyla possesses 13 years of experience in the Banking and Financial Industry on international level and holds several degrees in Advanced Corporate Finance, Management Economics and Advanced Studies on Blockchain and DLT. In 2018, co-founded company in Health Tech applying blockchain technology. Currently, Leyla is President of Swiss based NGO, Global Oracle Association for Leaders, GOAL, focused on Sustainable Development Goals, with aim on partnerships on governmental and private levels and expanding blockchain ecosystem. She has other several positions as Board Member at Blockchain Azerbaijan, Founder of Fintech company in Switzerland and Mentor at UNDP "Women in STEM" mentorship program, UNDP "Women in STEM. Leyla spoke at different conferences including World Economic Forum 2020, Convergence Blockchain Conference, FemTech panel as a part of the InnoWeek 2020 and moderated the event of Baku E-Trade Forum at World Net Summit 2020. At Blockchain Convergence Conference 2019, she spoke on regulatory environment and ecosystem for Blockchain in Azerbaijan and represented the Eastern Partnership countries as whole region to EU4Digital on Digital innovations, blockchain and scale-ups in emerging markets. Leyla has been chosen as one of 100 young successful people of Azerbaijan Republic under National Assembly of Youth Organisations of the Republic of Azerbaijan.

|

|---|

Daniel Benarroch

Daniel Benarroch

Director of Research, QEDIT & ZKPROOF.ORG, United States of America

Daniel Benarroch has over 10 years of experience in cryptographic and mathematics research. He has designed and built several products based on privacy-enhancing techniques and is currently leading strategy and the R&D team at QEDIT. He graduated with an M.Sc. in computer science from the Weizmann Institute and an M.A. in mathematics from the Johns Hopkins University.

|

|---|

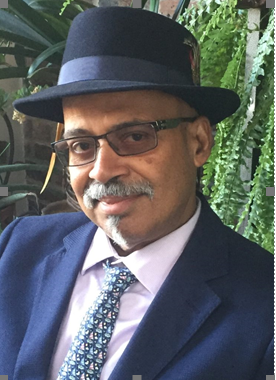

Vipin Bharathan Vipin Bharathan

Founder, dlt.nyc, United States of America

Vipin Bharathan is the founder of dlt.nyc, a consulting practice at the intersection of dlt, capital markets, technology, tokenization and regulation. Vipin is active in Hyperledger as chair of the Capital Markets Special Interest Group and the Identity Working Group. Vipin is a Forbes contributor on the topic of Blockchain and crypto-currencies. Vipin Bharathan is also a full-stack developer. He is a student of monetary theory, a practitioner of risk analysis and its connection to liquidity and market making. Vipin Bharathan helped build an open source CBDC called eThaler in Hyperledger labs. eThaler followed the ERC 1155 token standard and was built using the Token Taxonomy Framework. eThaler code was later re-purposed to build a carbon token. eThaler and an accompanying whitepaper was also demonstrated to the IMF, the World Bank, the BOE, the DCGI, IBM and other globally significant entities. Vipin Bharathan has worked in diverse Industries such as Retail Payments, Debt Capital Markets, Foreign Exchange, Insurance and Media.

|

|---|

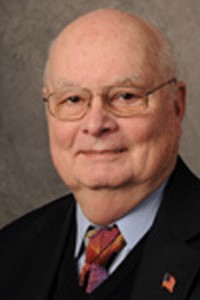

Richard Byles

Richard Byles

Governor, Central Bank of Jamaica

Richard Owen Byles was born in Kingston, Jamaica on 25 February 1951. He has served the private and public sectors in several senior management positions spanning three decades, and is one of the most accomplished corporate leaders of his generation. Mr. Byles was appointed Governor of Bank of Jamaica (BOJ) effective 19 August 2019. Before assuming the role of BOJ Governor, he served as Chairman of Sagicor Group Jamaica Limited following 13 successful years at the helm of Sagicor Group Jamaica as President and CEO. Prior to his tenure at Sagicor, Mr. Byles served as President and CEO at PanJam Investment Limited for 13 years. In addition to serving as Chairman for several Sagicor Group-related boards, he was also Chairman of several other boards, including Desnoes and Geddes Limited (Red Stripe Jamaica) and a Director on others, including PanJam Investment Limited. His public sector service includes serving as the first private sector Co-Chairman of Jamaica’s landmark Economic Programme Oversight Committee (EPOC). Mr. Byles holds a B.Sc. in Economics from the University of the West Indies, Mona, and a M.Sc. in National Development from the University of Bradford, England. He was awarded the Doctor of Humane Letters from Northern Caribbean University, and the Doctor of Business from the University College of the Caribbean.

|

|---|

Scott Carlson

Scott Carlson

Director, Global Architecture & Head of Blockchain COE

Scott Carlson brings technical leadership to Kudelski Security, a 70-year-old swiss technology company, strategic guidance to customers, and evangelism to the broader community. He plays a key role in developing innovative relationships between Kudelski and its technical alliance partners, developing emerging technology strategy and delivering trust solutions based on digital ledgers, cryptography, and blockchain. His career has included leadership positions as head of security strategy at PayPal, Charles Schwab, University of Phoenix, Technology Fellow at BeyondTrust, and was formerly CISO at Blockchain/Supply-Chain company Sweetbridge.

|

Jonathan Dharmapalan

Jonathan Dharmapalan

CEO, eCurrency

Jonathan Dharmapalan is the founder of eCurrency™ where he invented and pioneered the method to create central bank issued digital fiat currency. He is the recognized expert in digital currency, with expansive knowledge of policy, regulatory, operations and technical requirements for Central Bank Digital Currency (CBDC). Jonathan’s vision is to technologically empower central banks in the digital economy. As a pioneer in the field, Jonathan has worked with central banks around the world for over 10 years. He has led the innovation of technology to meet central bank requirements and to support the privacy, security and inclusion aspects of digital currency. Prior to establishing eCurrency, Jonathan was the head of Ernst & Young’s Global Telecommunications Practice. Jonathan was also a Senior Partner at Deloitte where he led the Global Technology, Media and Telecommunications consulting practice and led Deloitte’s Silicon Valley office. Jonathan has over 30 years of related technology and business experience. He holds a Bachelor of Science in Electrical Engineering from Northeastern University and Master of Science in Electrical Engineering from CALTECH (The California Institute of Technology). |

Dante Disparte

Dante Disparte

Chief Strategy Officer and Head of Global Policy, Circle, United States of America

Dante Disparte is Chief Strategy Officer and Head of Global Policy at Circle, responsible for overseeing company strategy, communications, policy and public affairs. Since joining Circle in 2021, his leadership in driving market expansion, regulatory engagement, and more have been integral in furthering the company’s mission to raise global economic prosperity through the frictionless exchange of financial value. Prior to joining Circle, Dante served as a founding executive of the Diem Association, leading policy, communications, membership and social impact. He also brings two decades of experience as an entrepreneur, business leader and global risk expert, most recently as founder and CEO of Risk Cooperative. He also serves as an appointee on the Federal Emergency Management Agency’s (FEMA) National Advisory Council and is a member of the World Economic Forum’s Digital Currency Governance Consortium and a life member of the Council on Foreign Relations. Additionally, he is co-author of “Global Risk Agility and Decision Making” (Macmillan 2016). He earned a bachelor’s degree from Goucher College, is a PLD graduate of Harvard Business School, and has an MSc in risk management from NYU Stern School of Business. Outside of work, Dante enjoys speaking and commentating, such as in media outlets including Harvard Business Review, Fortune, BBC, Forbes and Diplomatic Courier. Circle Internet |

|---|

Alex McDougall Alex McDougall

President & COO, Stablecorp, Canada

Alex McDougall is President & COO of Canada Stablecorp Inc. and Managing Director at 3iQ. Alex started his career as an investment banker at the Bank of Montreal, and left in 2018 to co-found Bicameral Ventures. Bicameral’s platform focused on “Interconnected Investing” and building a portfolio of projects used to bring new tech paradigms into reality. Bicameral’s themes generally include blockchain, interoperability, data and identity self-sovereignty, personalized AI, and Web 3.0.

|

|---|

Daniel Eidan Daniel Eidan

Advisor, Bank for International Settlements Innovation Hub

Daniel is an Adviser and Solution Architect at the Bank for International Settlements (BIS) in the Innovation Hub where he builds technology solutions for the central banking community with a special focus on blockchain and CBDC. Before the BIS he was lead digital currency work at R3, was a software engineer manager and a technical educator. He started his career as an Infantry Combat Commander in the Israeli army and received an honours degree in Computer Science and Mathematics from the University of Toronto.

|

|---|

Fatemeh Fannizadeh Fatemeh Fannizadeh

Crypto Legal Advisor, Switzerland

Fatemeh Fannizadeh is a Swiss qualified lawyer and independent practitioner. Since five years, she advises blockchain projects of public interest throughout their development and leads teams of international external counsels to address specific regulatory and dispute resolution needs of the clients. Her advise covers all areas of legal needs, while mainly focusing on holistic crypto legal risks mitigation. She benefits from a global overview of regulations, policy trends and lobbying efforts, and attempts actively to open-source legal knowledge in the space. She recently co-authored a checklist, freely available online, for projects to assess and mitigate their exposure to crypto legal risks. Her background prior to crypto is in white collar crime, criminal defense and high-profile commercial dispute resolution. Her research focuses on the governance of technological commons and the study of legal philosophy. She is passionate about the disruptive and evolutive potential of crypto, mesh networks, peer to peer data networks and privacy tech.

|

|---|

Julio Faura

Julio Faura

CEO, Adhara.io

Julio’s career has been running for more than 20 years along the worlds of Technology and Financial Services, and he now focuses on digital assets, blockchain and distributed ledgers, particularly on their applications for financial institutions, public institutions and enterprises in general. He started out as chip designer, then worked for 6 years at McKinsey & Co serving top financial institutions globally, and then worked for 11 years for Santander, playing many corporate leadership roles in Investment Banking, Consumer Finance, IT & Operations, and global M&A. He has been leading Santander's activities around crypto-currencies, blockchain and distributed ledgers for years, and has led the creation of many relevant industry consortia. He was the founding chairman of the Enterprise Ethereum Alliance, the founding chairman of Spain's Alastria network, a member of the board of the Wall Street Blockchain Alliance, and an advisor to startups, corporates and regulatory / government bodies regarding blockchain technology and their implications In July 2018 Julio became a full time entrepreneur and CEO of Adhara, a company that seeks to help financial institutions and corporates leverage smart contracts and blockchain to improve the execution of international payments and optimize liquidity management, in partnership with ConsenSys. An engineer at heart, Julio holds a TelecommunicationEngineering degree from UPM-Spain, a PhD in Computer Science / Electrical Engineering from UAM-Spain, and a MsC in Management of Technology from MIT-Sloan.

|

|---|

Jacques Remi Francoeur Jacques Remi Francoeur

Chief Scientist, Security Inclusion Now, United States

Jacques is the founder and Chief Scientist of Security Inclusion Now - USA, a California-based consulting, training and software organization innovating in security tool development. Jacques is also a member of the World Economic Forum Expert Network recognized as a Blockchain security expert and the lead of the Security & Assurance Working Group of the Future of Digital Currency Global Initiative, a joint program of UN-ITU/Stanford University. Jacques has over 30+ years of experience in high technology beginning his career as an Aerospace Engineer with the Canadian Space Agency, next moving to Silicon Valley in 1999, beginning his privacy and security consulting advisory career with KPMG, followed by SAIC and E&Y. Jacques is a 2018/19/20 US Delegate to the U.S. Department of State to the International Telecommunications Union (ITU), Standardization Study Group 17: Security. He was also Vice Chair of the ITU Focus Group on Digital Fiat Currency and co-chair of the Security Working Group. Finally, Jacques supports San Jose State University as a Faculty Cyber Executive-in-Residence. Jacques has an MBA with honors from Concordia University, Montreal; M.A.Sc from the University of Toronto, Institute for Aerospace Studies and a B.A.Sc. in Engineering Science, Aerospace Engineering from the University of Toronto.

|

|---|

Geoffrey Goodell Geoffrey Goodell

Lecturer, University College London

Dr Goodell has roughly a decade of experience as a strategist and portfolio manager in the financial industry, having served most recently as Partner and Chief Investment Officer of a boutique asset management firm based in Boston, where he led the design, implementation, and management of investment strategies in systematic macro trading and statistical arbitrage. Previously, he was an associate in the corporate credit and structured products groups at Goldman Sachs in New York. Dr Goodell's research has contributed to knowledge of the interface between computer science, finance, and public policy in areas related to digital marketplaces, digital payment systems, and regulation.

|

|---|

Gueorgui Gotzev Gueorgui Gotzev

Fintech & Blockchain Lawyer, KOHLER GOTZEV, Luxembourg

Gueorgui holds a LL.M. in International Financial Law from the University of Paris 1 – Panthéon Sorbonne and has completed full qualification course in Luxembourg law (CCDL) from the University of Luxembourg. He is the Blockchain, Fintech & Asset digitalization practice leader at KOHLER GOTZEV where he adivses private and corporate clients in the wealth management industry and financial sector professionals on legal, regulatory and compliance matters involving cross boarder aspects and a wide variety of national laws. Gueorgui is a fully qualified under Bulgarian, French and Luxembourg laws and has been admitted to practice in Luxembourg and is currently admitted to the Sofia Bar Council.Gueorgui regularly collaborates and co-authors articles with academics and other professionals. He is a guest lecturer with the Blockchain Certificate of Advanced Studies (CAS) at the University of Geneva, Switzerland and contributes to continuing legal education on Legal Aspects of Digital Finance with the Institut Supérieur de Formation Bancaire-ISFB in Geneva, Switzerland.

|

|---|

Catherine Gu Catherine Gu

Global CBDC Lead, Visa, United States of America

Catherine is the Global CBDC Lead at Visa. She heads Visa’s Global CBDC program, building digital payment solutions with central banks, financial partners and global infrastructure technology companies. Prior to Visa, Catherine worked at J.P. Morgan and Man Group in quantitative finance. She spent 2 years on stablecoin research while at Stanford University with Prof. Dan Boneh. She also worked at 2 crypto startups: Anchorage and Gauntlet. Catherine graduated with M.S. in Management Science & Engineering from Stanford University, and First Class B.A. and M.Phil in Economics from University of Cambridge.

|

Bejoy Das Gupta Bejoy Das Gupta

Chief Economist, eCurrency, United States of America

Dr. Das Gupta is the Washington DC-based Chief Economist of eCurrency, the Silicon Valley firm at the cutting edge of technology for powering a central bank digital currency (CBDC). He leads the engagement with central banks, regulators and multilateral institutions, articulating the need for CBDCs and design, implementation, and policy considerations. He is a Vice Team Leader of the Working Group on Policy and Governance of the ITU’s Digital Currency Global Initiative. He is also a Member of the Bank of England’s CBDC Technology Forum, advising on the explorations for a potential UK CBDC. Dr. Das Gupta was formerly the Chief Economist for Asia/Pacific at the IIF, where he managed the economic analysis of the Asian region and led its regional engagement/partnerships. He was a Founding Advisory Board Member of the Mandiri Institute in Indonesia. Dr. Das Gupta also serves as Adjunct Professor at the Washington DC Program of the Maxwell School of Citizenship and Public Affairs, teaching highly-regarded graduate courses on development, capital flows, national security, and the frontier of finance. He is a graduate of the LSE and holds a masters and a doctorate from Oxford University.

|

Bilel Jamoussi Bilel Jamoussi

Chief of Study Group Department, TSB, ITU

Tunisian born, Dr. Bilel Jamoussi is Chief of the Study Groups Department of ITU Standardization Bureau in Geneva Switzerland. Since 2010, he has been leading the bureau’s standards making activities into a new era characterized by rapid convergence and the need for increased collaboration with vertical sectors and partnership between developed and developing countries. Prior to 2010, Jamoussi worked for a Telecommunication equipment and solutions provider for 15 years in Canada and then in the United States where he held several leadership positions and was granted 22 US patents in diverse areas including packet, optical, wireless, and quality of service. He holds a BSc, MSc and PhD degrees in Computer Engineering from the Pennsylvania State University, USA. He is fluent in Arabic, French, and English and speaks some Spanish and German. |

|---|

Wei Kai Wei Kai

ITU-T Study Group 16 Q22 Rapporteur Secretary/ General of TBI, CAICT

Mr. Wei Kai is Chairman of ITU-T Focus Group on Application of Distributed Ledger Technology(FG DLT). He is the Vice Director of Cloud and Big Data Institute, China Academy of Information and Communications Technology(CAICT). He leads a research group in CAICT working on big data and blockchain technology, consulting, standardization, testing and certification. His team proposed the Trusted Blockchain framework, which is a framework for Blockchain and DLT platform assessment. He is the founder and the Secretary General of Trusted Blockchain Initiatives(TBI), a cooperation network of 300 blockchain commpanies from China and abroad. He was the core drafting group of several Chinese national industrial policy and standards in ICT area in the past years. Wei Kai is also the Rapporteur of Question 22 under ITU-T Study Group 16.

|

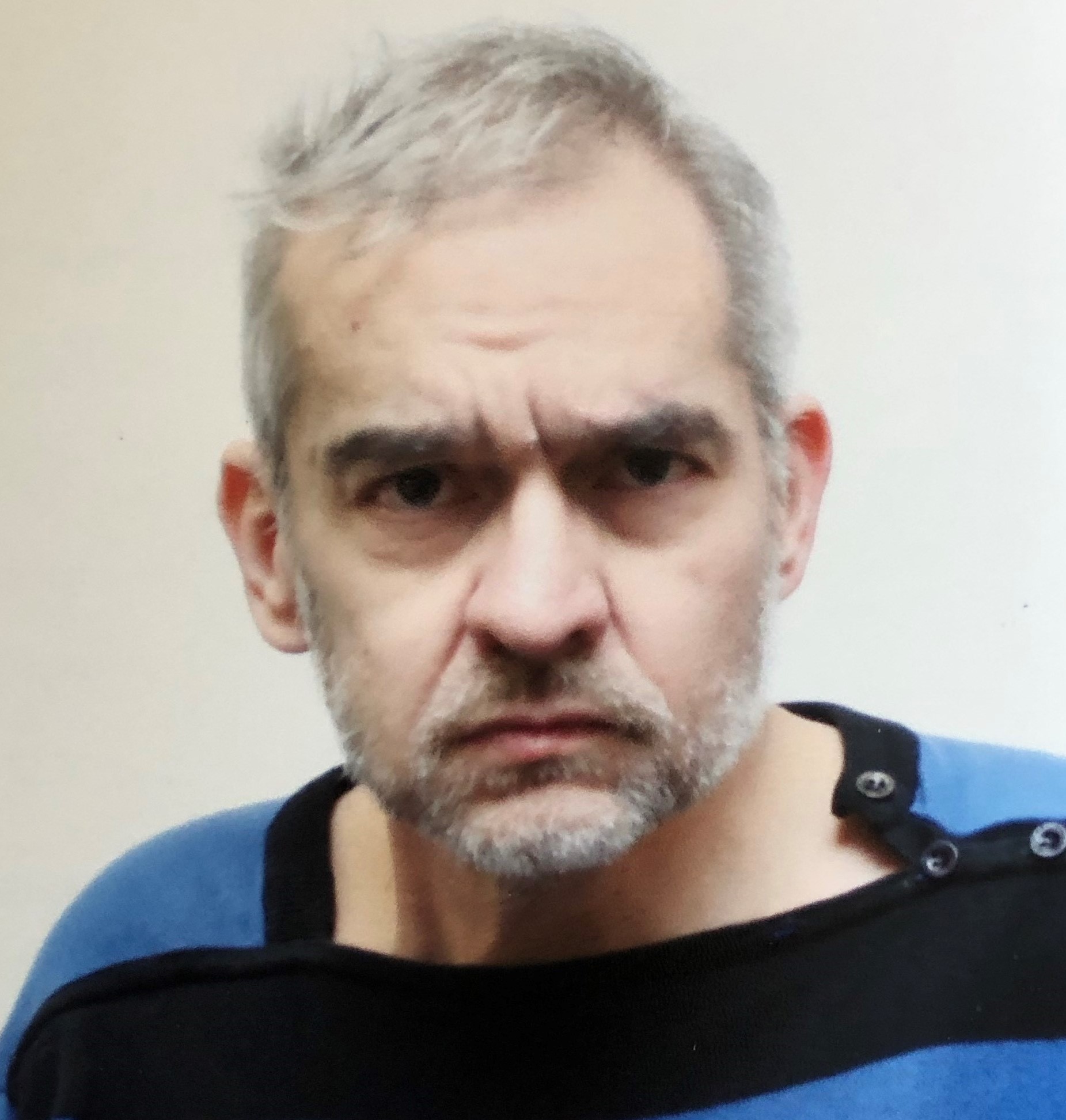

Peter Kerstens

Peter Kerstens

Advisor, European Commission

Peter advises on Technological Innovation, Digital Transformation and Cybersecurity at the European Commission’s Directorate-General for Financial Stability, Financial Services and Capital Markets Union. He has led work on the European Commission’s Fintech Action Plan and Co-chairs the European Commission’s Fintech Taskforce. He has extensive experience and expertise in EU policy and regulation covering financial services, digitalisation, security and consumer protection. Earlier in his career, Peter was Finance Counsellor at the EU Embassy in Washington DC. He has also been a member of the private offices of the commissioner for the internal market and services and the commissioner for health and consumer protection. Before joining the European Commission, Peter advised major financial services companies on EU regulatory affairs. He is a Dutch national and holds master degrees in European affairs and political science from the College of Europe in Bruges and the University of Leuven, Belgium.

|

|---|

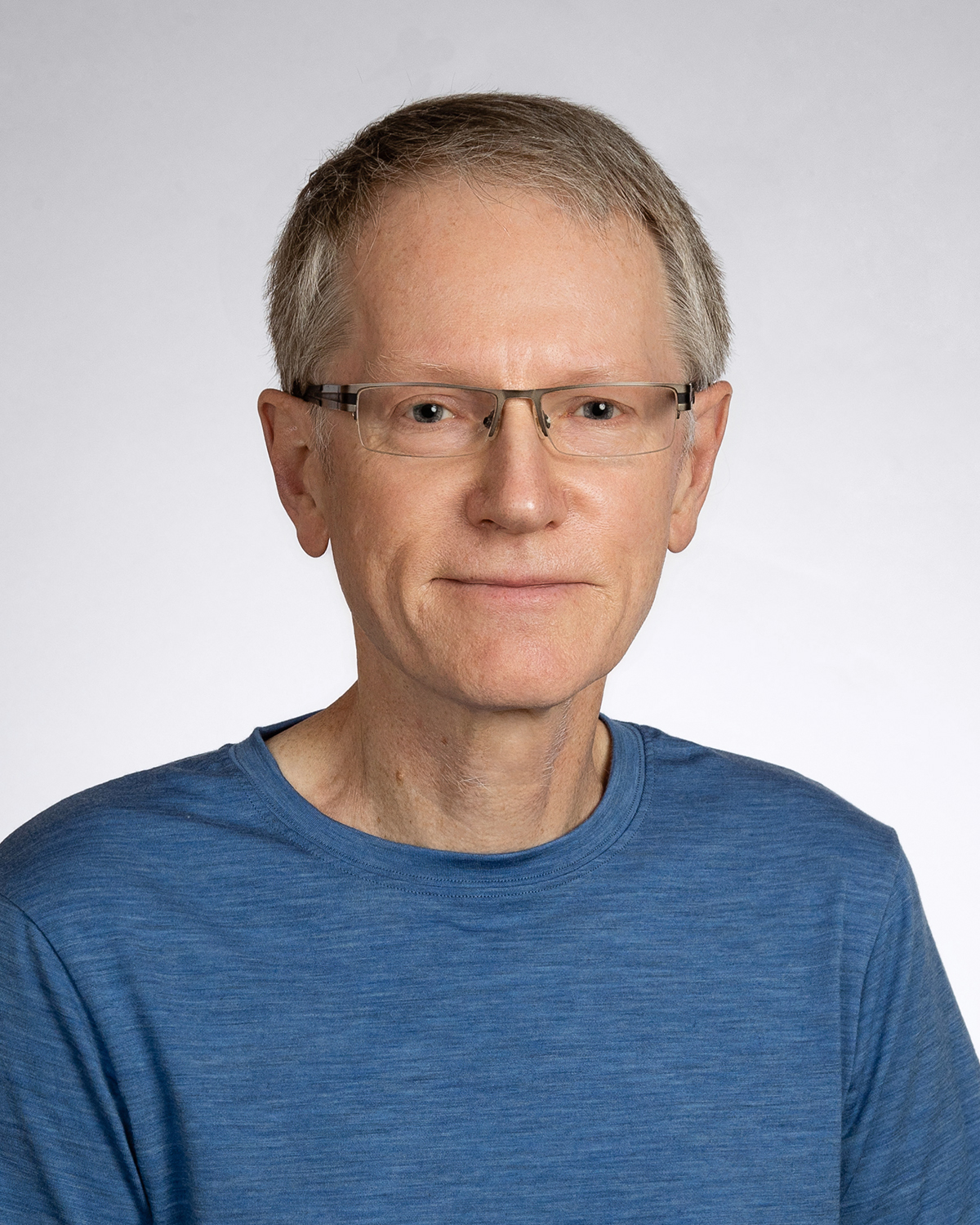

John Kiff John Kiff

Senior Financial Sector Expert, International Monetary Fund (IMF)

John Kiff has been a Senior Financial Sector Expert at the International Monetary Fund (IMF) since 2005. Prior to that, he worked at the Bank of Canada for 25 years, where he spent most of his time managing the funding and investment of the government’s foreign exchange reserves, including running its large interest rate and currency swap book. At the IMF he was part of the team that produces the semi-annual Global Financial Stability Report. More recently he has been focusing on fintech issues, over-the-counter derivatives, and pension risk transfer markets. He has published many articles and papers on these topics, and actively tweets on them on Twitter (@Kiffmeister).

|

|---|

Stéphanie Lelaurin Stéphanie Lelaurin

Decentralized Finance and Blockchain Specialist

SL has devoted her career to facilitate and accelerate transformational changes assisting leaders of disruptive and impactful start-ups and organizations. Since 2018 she specializes in fostering the adoption and use of Blockchain and Decentralized Finance solutions for massive financial empowerment of vulnerable populations and protection of common goods to support the UN SDGs fulfillment.

|

Paul Lloyd Paul Lloyd

Cybersecurity Strategist, Hewlett Packard Enterprise (HPE), United States of America

Paul’s formal education background consists of degrees in Mathematics and Computer Science from the New Mexico Institute of Mining and Technology.Paul has 35+ years of experience in the software and computer industry. He has been a software developer throughout that time is deeply familiar with the cybersecurity aspects of software development and large, distributed software systems. He has also been the architect of complex software systems. Paul has 20+ years of experience as a cybersecurity architect and strategist with a focus on crypto system engineering. He has been the chief architect of enterprise scale PKI deployments and has worked with C-level executives on formulating cybersecurity strategy.

|

|---|

Daniel Lynch Daniel Lynch

Strategy FIs and Fintech, Consensys

Daniel Lynch works for Consensys in New York covering strategic engagements in the Americas with banks, custodians, funds, central banks and fintechs. Previous to Consensys Daniel managed the SWIFT Payments Innovation initiatives in the Americas and UK.

|

Tommaso Mancini-Griffoli Tommaso Mancini-Griffoli

Division Chief, Monetary, Capital Markets Department, International Monetary Fund (IMF)

Tommaso Mancini-Griffoli is the Division Chief of the Payments, Currencies, and Infrastructure division at the International Monetary Fund (IMF). His work focuses on digital currencies and payments, monetary policy, foreign exchange interventions, modelling, and central banking operations and communication. He has advised country authorities and published widely on these topics. Prior to joining the IMF, Mr. Mancini-Griffoli was a senior economist in the Research and Monetary Policy Division of the Swiss National Bank, where he advised the Board on quarterly monetary policy decisions. Mr. Mancini-Griffoli spent prior years in the private sector, at Goldman Sachs, the Boston Consulting Group, and technology startups in the Silicon Valley. He holds a PhD from the Graduate Institute in Geneva, and prior degrees from the London School of Economics and Stanford University.

|

|---|

Vijay Mauree Vijay Mauree

Programme Coordinator, Telecommunication Standardization Bureau, ITU

Vijay Mauree joined the ITU, in 2010 and has over 20 years of experience in project management and cybersecurity. He is the focal point for Digital Financial Services at the Standardization Bureau in ITU. He is currently coordinating the work of the Financial Inclusion Global Initiative (FIGI) which is a joint programme of the ITU, World Bank, Bank for International Settlements and supported by the Bill & Melinda Gates Foundation. He also leads the FIGI Security, Infrastructure and Trust Working Group which is investigating the security threats to the DFS Ecosystem and developing technical reports and guidelines to enhance trust in DFS. He is also leading the DFS Security Lab conducts security audits on DFS applications used in emerging economies and collaborates with DFS regulators and providers to enhance security of digital finance. In addition, Vijay coordinates the secretariat for the Digital Currency Global Initiative which is a collaboration between ITU and Stanford Digital Currency Program. The Digital Currency Global Initiative is investigating areas where technical standards for Central Bank Digital Currency, Stablecoins, eMoney and cryptocurrency are required. He coordinated the work of the ITU-T Focus Group Digital Financial Services and ITU-T Focus Group Digital Currency including Digital Fiat Currency. He was previously responsible for the implementation of projects under Bridging the Standardization Gap programme and undertaking research for production of Technology Watch reports. He published four Technology Watch reports on Optical networks, Smart Water Management, Privacy in the Cloud and Mobile Money. Vijay received his first degree in Computer Science with Electronic Engineering from University College London, UK and obtained his Masters degree in Information Technology from Imperial College, Science and Technology, UK. He also holds an MBA from Cranfield School of Management in UK.

|

David Mazieres David Mazieres

Director, Stanford Future of Digital Currency Program, United States of America

David Mazières is a professor of Computer Science at Stanford University, where he leads the Secure Computer Systems research group and co-directs the

Center for Blockchain Research and

Future of Digital Currency Initiative. His research interests include Operating Systems and Distributed Systems, with a particular focus on security. He is also a co-founder of the

Stellar Development Foundation.

|

David Mills David Mills

Associate Director, Board of Governors of the Federal Reserve System

David Mills is an Associate Director at the Board of Governors of the Federal Reserve System – Division of Reserve Bank Operations and Payment Systems, Washington, District of Columbia. He has responsibilities for the Board’s innovations in payments, retail payments, and payments economic research programs. David has been studying developments in digital currencies and distributed ledger technologies for several years. He leads several Federal Reserve policy and research teams in the areas of digital innovations including the Federal Reserve Board’s efforts around central bank digital currency and stablecoins, and is an active contributor to international work on the topics. He has published articles related to payments and monetary theory in a variety of journals including the Journal of Monetary Economics, the International Economic Review, the Review of Economic Dynamics and Macroeconomic Dynamics. He received his Ph.D. in Economics from the Pennsylvania State University and has a B.A. in Economics and Classical Languages from Duquesne University in Pittsburgh, Pennsylvania.

|

Saule Omarova Saule Omarova

Beth and Marc Goldberg Professor of Law, Cornell University

Saule T. Omarova is the Beth and Marc Goldberg Professor of Law and Director of the Jack Clarke Program on the Law and Regulation of Financial Institutions and Markets at Cornell University. Professor Omarova’s research focuses on systemic risk regulation and structural trends in financial markets, banking law, and political economy of finance. Prior to joining academia, she practiced law at Davis Polk & Wardwell, a premier New York law firm, and served at the U.S. Department of the Treasury as a Special Advisor for Regulatory Policy to the Under Secretary for Domestic Finance. In 2021, Professor Omarova was President Biden’s nominee for the post of the U.S. Comptroller of the Currency. She holds a Ph.D. degree in Political Science from the University of Wisconsin-Madison and a J.D. degree from Northwestern University.

|

Chris Ostrowski Chris Ostrowski

Global Head, Public Sector Engagement, Celo, United States of America

Chris Ostrowski is the Global Head of Public Sector Engagement at cLabs - working on Celo. Celo is a mobile-first blockchain. By offering new digital financial tools, currencies and payment options to anyone with a mobile phone, Celo endeavours to bring financial inclusion and empowerment to everyone.Previously, Chris was the Chief Revenue Officer of OMFIF, a central bank thinktank based in London, and Managing Director of the Digital Monetary Institute (DMI) – an independent platform for convening central banks on CBDCs, digital payments, the DLT and blockchain.

|

Sandra Ro Sandra Ro

CEO, Global Blockchain Business Council

Sandra is a proponent for ‘human-centric tech’. She left a career in derivatives, investment banking and currency markets to focus on emerging technologies for sustainability, access, and resiliency, particularly in financial systems. She is an early investor in, and an advocate of crypto and digital assets. Sandra currently serves as the CEO of the Global Blockchain Business Council (GBBC), a Swiss-based non-profit consisting of more than 350 institutional members, 130 ambassadors across 76 jurisdictions and disciplines, as well as an angel investor in emerging technologies, Board member, advisor, keynote speaker and cofounder of several start-ups, non-profits, and key blockchain industry networks.She is currently Board director of Global Digital Finance (UK) NYS Senate appointee on the New York State Digital Currency Task Force, Fintech Advisory Council of Astana International Financial Center (AIFC Kazakhstan), Board Treasurer of BitGive Foundation, member of EU Public Funds and New Green Economy Consortia, Chair of Open Impact Foundation (Switzerland), Advisory Board of Filecoin Foundation, Health Tech Chair of Yale Alumni Health Network (YAHN), and member of World Economic Forum’s Digital Currency Governance Consortium (DCGC), US Department of State Speakers Bureau, Standards, International Securities Services Association (ISSA).Whilst at CME Group, she founded and led Digitization, developed the CME CF Bitcoin pricing indices, followed by the CME Bitcoin Futures and DLT solutions. Ro was a founding member of Enterprise Ethereum Alliance (EEA Board), Post Trade Distributed Ledger (PTDL) Group, Linux Foundation, Hyperledger, and GBBC Board. She holds six patents across derivatives, crypto and indices. Previously, she was a derivatives banker at Morgan Stanley and Deutsche Bank, based in London. She is a graduate of Yale University, B.A. double major in (Military) History and Studies in the Environment, student of Computer Science at Columbia University, School of Continuing Studies, and MBA recipient in Accounting and Finance from London Business School.

|

Jean-Marc Seigneur Jean-Marc Seigneur

Director of the blockchain certificate of advanced studies, University of Geneva

PD Dr. Jean-Marc Seigneur has published more than 140 peer-reviewed scientific publications worldwide in the field of decentralized trust. He is the director of the blockchain certificate of advanced studies at the University of Geneva. He has evaluated multi-million Euros blockchain project proposals for the European Commission. He has also directed such projects as principal investigator at the University of Geneva. He has taught, presented, and discussed blockchain, crypto-currencies, and decentralized finance at many international conferences and several governmental and international organizations (Digital Ministry of Thailand, World Intellectual Property Organization, State of Geneva...). His research focus is now on decentralized finance for good including offline crypto transactions with hardware wallets and trusted execution environments.

|

Edward Scheidt Edward Scheidt

Convenor of ISO TC68/SC2 - Working group 17

Financial Security Sector History

Mr Scheidt serves as the convenyor of ISO SC2 Working Group 17 (Security Aspects of Digital Currencies) and liaison between ISO and ITU for digital currency security. He is also the U.S. Vice chair, ANSI x9f Global Security Standards. and the head of ISO US delegation to ISO TC68 SC2 Financial Services, Security. Before his current functions, he was head of the United States ANSI x9 Accredited Standards x9f data and information security committee. X9f committee consists of three security subcommittees: cryptography, protocols, and retail. He has also served as an advisor to the Federal Reserve Security Task Force. He is a member of Tecsec – a security research and solution company providing support to the financial sector. He is a patent inventor of multiple U.S. and international patents regarding the subject of cryptography and information security. Edward has written several cyber papers in standards support.

|

Cecilia Skingsley

Cecilia Skingsley

First Deputy Governor, Riksbank, Sweden

Cecilia Skingsley took up the post of Deputy Governor in 2013. In November 2019, she was appointed First Deputy Governor.

Cecilia Skingsley has previously held the post of Chief Economist at Swedbank and has also worked at Dagens industri, ABN Amro Bank and the Ministry of Finance. She holds a BA in Economics and Political Science and a financial analyst diploma. Cecilia represents the Riksbank on the Committee on Payments and Market Infrastructures (CPMI) and on the Euro Retail Payments Board (ERPB). She is also the Governor of the Riksbank’s alternate on the General Council of the ECB and is a member of the Advisory Technical Committee (ATC) of the European Systemic Risk Board (ESRB). In addition, Cecilia chairs the retail payments council, the cash management advisory board and is a member of the Financial Stability Council.

|

Lisa JY Tan Lisa JY Tan

Economist, Economics Design, Singapore

Lisa is the founder and lead economist at Economics Design, a research focused consultancy for digital ecosystems. In the academia world, she contributes to research work in various fields like math and economics, while having the practitioner exposure with startups and global businesses.

|

Peerapong Thonnagith Peerapong Thonnagith

Assistant Director & Technical Lead, Digital Currency Team, Bank of Thailand

Mr.Peerapong Thonnagith is currently an Assistant Director of Digital Currency team at the Bank of Thailand. He is responsible for the technical development under ongoing projects of both wholesale CBDC (currently transformed into m-CBDC bridge) and retail CBDC. Before joining the Bank of Thailand, Peerapong was an assistant director of the Securities and Exchange Commission Thailand's FinTech Department, he was responsible for the process of approving ICO portals and giving advice to potential neat-to-come ICOs especially in blockchain/DLT-related topics. Moreover, he experienced in monitoring and prosecuting process on criminal cases that involve the use of cryptocurrencies and digital tokens under jurisdiction of the Emergency Decree on Digital Asset Businesses B.E. 2561. Peerapong holds a Bachelor of Engineering (Computer Engineering, second-class honors) and a Master of Engineering (Computer Engineering) from Chulalongkorn University, Thailand

|

Herve Tourpe

Herve Tourpe

Chief Digital Advisor, IMF

He leads a team of digital experts in transformative technologies relevant to IMF’s Member Countries, such as Fintech, AI, Blockchain, Big Data, cloud and the related cyber risks. A passionate “techno-realist”, he strives to provide unbiased and cross-country expertise on technology trends, opportunities and risks, especially for emerging and low-income countries. Mr. Tourpe is an expert in national digital strategies, with a particular focus on financial inclusion, sustainable development, digital payment and Central Bank Digital Currencies. Formerly Chief E

|

|---|

Kathryn White Kathryn White

Accenture Fellow, World Economic Forum

Kathryn White is an Accenture Fellow at the World Economic Forum’s Centre for the Fourth Industrial Revolution based in San Francisco. She has co-lead the Forum’s Digital Currency Governance Consortium (DCGC) since its inception in April 2020, co-authoring white papers about blockchain for cross-border aid, privacy for CBDC, and interoperability for CBDC and stablecoins. Kathryn has also been with Accenture for 10 years working with clients on systems integration and technology incubation and innovation. Kathryn attended the University of Southern California as an undergraduate and is currently earning her Masters in Public Affairs at UC Berkeley.

|

Guangbo Zhang Guangbo Zhang

Managing Partner, Web3 Capital, Singapore

Guangbo Zhang is managing partner of Web3 Capital, a decentralized venture capital backing entrepreneurs building the future through web3 technology. Web3 capital aims to connect entrepreneurs, developers, academics and others in web3 technology ecosystem. Guangbo is responsible for analyzing projects with potential investment value, capital allocation, communication, public affairs. Guided by complex system theory what he studied during his PhD career in University of Cambridge, the investment portfolio of Web3 Capital has and only has Ethereum, MakerDao, Polkadot and Acala. Prior to Web3 Capital, Guangbo worked at Center for Blockchain Technology in University College London as senior researcher, exploring and designing mechanism of decentralized finance (Defi) in 2017. He was also one of the core members of the first national blockchain project in China.

|