A digital economy is characterized by online transactions and engagement – a virtual, paperless and cashless world. It harnesses a range of technologies, services and business models that improve personalization through human-centred design and create new opportunities and markets. It involves the following ambitions:

- All transactions are electronic, integrated, and secure – from registration through to employment, reporting, marketing, banking, accounting and security

- People have the capabilities to confidently use and create digital technology, forming the skilled workforce needed to help businesses reach and operate at the digital frontier

- Government services are all easily and safely accessible online, saving people time and money

- The government’s delivery of targeted services, policies and programmes is supported by the availability and sharing of public data

- Smart regulations and initiatives are implemented to ensure the safest and most cyber-secure environment for working online, building trust in the digital economy and opening up new economic opportunities

Key issue: Financial exclusion

Financial inclusion has been a recurring priority for many countries to empower individuals and MSMEs to meet their basic needs and engage in meaningful economic activities. Yet there approximately more than 1 billion unbanked adults worldwide, who do not have a basic transaction account.[122] A barrier for about 67 per cent of them is cost.[123] Services are unaffordable and the locations of financial service providers are often inaccessible. Other barriers to financial inclusion would be customers’ mistrust of providers and lack of required documentation and/or knowledge, and banks’ failure to offer suitable products, including safe and secure online banking services. As the digital economy is dependent on banked transactions, these unbanked adults are excluded from it. Without access to financial services, individuals and MSMEs struggle to partake in and contribute to the digital economy meaningfully. The growth of this economy increases the need for people to be banked, and if the status quo persists, the consequences of financial exclusion will become ever more burdensome.

Potential interventions:

A) Digital financial inclusion

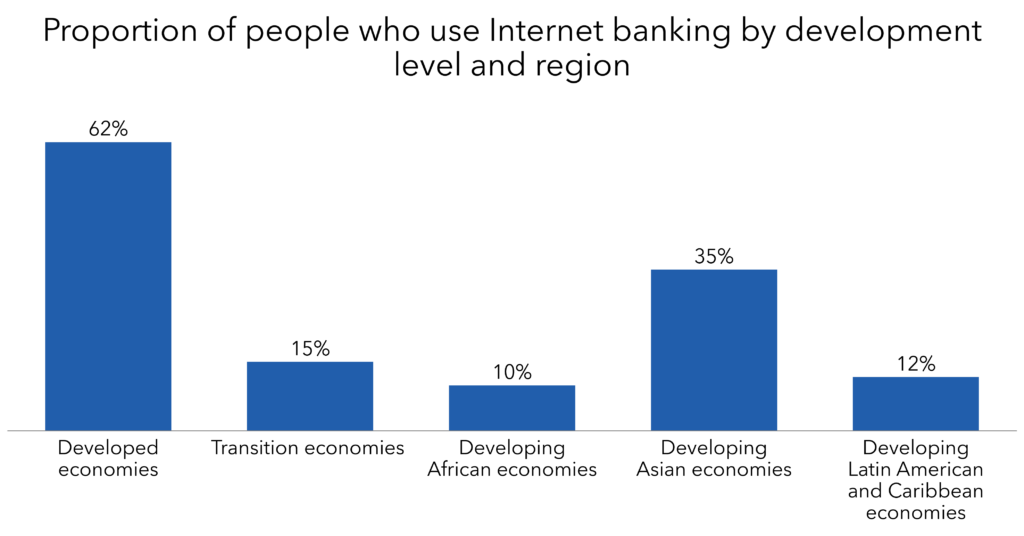

Innovations in the financial technology (fintech) space are enablers for expanding financial inclusion, as they help remove barriers. For example, mobile phones have addressed the inaccessibility of financial service providers and facilitated more direct, immediate, convenient and user-controlled access. Other digital channels such as online banking platforms, mobile apps and software have helped extend digital financial services (DFS) to unbanked people. However, there is still room for improvement as only 62 per cent of individuals in the developed economies and less than 35 per cent in developing economies leverage Internet banking (see Figure 26). Safe and secure online banking should be scaled up rapidly, particularly in developing countries.

DFS are delivering a new frontier in economic growth and financial inclusion. They are strengthening the capacity of domestic financial institutions and encouraging and expanding access to banking, insurance and financial services for more of the population than ever before. In particular, they are increasing the access of small-scale industrial and MSMEs to financial services including affordable credit, especially in economies without suitable credit markets.

In parallel, financial health and literacy should be improved to ensure that people gain from their inclusion. People need to trust that their money is secure in a digital account and that transactions will be performed as instructed with an accurate record. Using DFS should be affordable not only for consumers but also merchants. Systems should be convenient, user-friendly, and easily accessible, with simple onboarding. As DFS continue to be scaled up, policies that encourage innovation, multistakeholder collaborations and responsible finance should be established. This includes generating a service-based approach to DFS, consumer protection regulations that are applicable to DFS, and market conduct regulations for non-bank agents that are on a par with those of bank agents.

The COVID-19 pandemic is driving a large-scale shift toward digital markets and finance. The digitalization of finance, for both individuals and businesses, can decrease costs and introduce new market and livelihood opportunities, enabling countries to rebound as the pandemic subsides. However, the pandemic has also hindered the growth of the industry’s smaller players and emphasized individuals’ unequal access to digital infrastructure. To allow everyone to build back better, it is essential to strike a balance between enabling financial innovation and mitigating risks and challenges (e.g. the need to enhance financial and digital literacy, foster affordable access to digital infrastructure, guarantee data privacy, and tackle data biases and cyberthreats).

Spotlight

Africa’s largest fintech platform, M-PESA, is a mobile money service provided by Vodafone and Safaricom that is committed to allowing both banked and unbanked users to make payments safely. It has given more than 49 million people access to sending and receiving money, buying airtime, paying bills, receiving salaries and obtaining short-term loans safely, securely and affordably. [125]

Key issue: Slow digitalization of businesses

As the world continues to invent more digital technology and operate more digitally so too do economies growing increasingly more digital. The digitalization of businesses can increase productivity, reduce costs, and increase the potential market, resulting in economic growth. Countries have considerable differences in their readiness, which risk widening the gap with those that are not sufficiently prepared. Similarly, large corporations have mostly been able to transition but MSMEs lag. MSMEs, particularly in developing countries, may face more barriers such as limited access to ICT, unaffordable technologies, high cost of entry and a lack of capabilities to adopt interventions. The digitalization of key activities in an economy can build the resilience of the ecosystem. During the COVID-19 pandemic, the benefits and criticality of digitalizing health care, education, remote working and essential B2C commerce were made apparent. The other challenge is encouraging consumers to partake in e-commerce. People who are connected to the Internet use it to perform various activities. In developing countries, less than 10 per cent of Internet users shop online but in European countries more than 80 per cent of users do.[126] Figure 27 illustrates the gap between developed and developing economics in other Internet activity across global regions.

Potential interventions:

A) E-commerce enablers

The rate at which the digital economy is expanding demands quick global action to minimize the inequalities among countries, businesses and individuals. Updated or new policies and regulatory frameworks that tackle the barriers to digitalization are critical. These should be informed by research, data and statistics on local economic digitalization and potential outcomes. Digital public infrastructure and goods should be utilized to ensure inclusion. Alternatively, digital technology can be made accessible and affordable for all through financing or investments. Addressing the high cost of entry into e-commerce for global MSMEs will make innovation possible at the grassroot levels. Technical support can be provided to LDCs, LLDCs and SIDS through partnerships with the private and social sectors or even multilateral agreements. A coordinated approach to implementing and regulating e-commerce should be prepared through multistakeholder engagement at an international level. E-commerce software interventions can be made available in off-the-shelf products to enable MSMEs to digitalize easily and quickly without needing IT capabilities.

B) Digitalisation of B2B commerce and supply chains

The digitalization of B2B commerce has expanded commercial opportunities, broadened companies’ reach to new buyers and markets, improved sales, increased efficiency and delivery speed, reduced costs, strengthened data analytics and enhanced scalability. At five times the value of B2C, the global B2B e-commerce has a market value of about USD 14.9 trillion.[128] Nearly 80 per cent of the market share is in the Asia Pacific region, excluding not only other developed regions (e.g. North America and Europe) but also developing countries in Latin America and Africa.[129]

Digital technology is redefining supply chain management by incorporating strategic considerations facing the business, considering the end-to-end visibility and implications, interacting dynamically with integrated business-planning capabilities, and leveraging advanced analytics for agile and smart decision-making. Similar to B2B e-commerce, it also delivers significant impact, including increasing revenue, improving service, driving profitability, optimizing supply chain costs and strengthening resilience.

To enable MSMEs to benefit from both B2B trade and digital supply chains, there needs to be a clear digital strategy supported by the capacity to operate efficiently, integration with existing business models and processes, and financing to obtain and implement the necessary digital tools. Both digital B2B and supply chains should be expanded beyond multinational corporations and MSMEs to include the social sector, especially education and health care. Multistakeholder partnerships across sectors and industries can help by making digital tools accessible, developing expertise, and assisting with financing. CSPs are already collaborating with cloud service providers and technology partners to accelerate the digital transformation of cloud businesses, such as the partnership between Airtel, Cisco and Google Cloud.

Spotlight

HeHe, the largest e-commerce business in Rwanda, has established its own Innovation Academy (iHAC) to drive non-profit research and provide an innovation tank to prepare potential entrepreneurs. One of its initiatives, Innovate for Impact, is an executive fellowship programme that is committed to helping African organizations develop digital interventions, including digitalizing rural supply chains in Africa.ns in Africa. [130]

Key issue: Cyberthreats, cyberattacks and cybercrimes

Cybersecurity continues to be a growing concern as digital economies grown with innovative digital products and services. With more economic activity occurring online, there is a greater incidence and risk of cybercrimes. On average, more than 4,800 unique websites are compromised per month by formjacking attacks (where cybercriminals steal shoppers’ credit card details). Ransomware (malware that holds personal information for ransom) attacks on enterprises increased by 12 per cent in 2018.[131] In the same year, supply chain attacks increased sharply by 78 per cent.[132] About 10 per cent of groups launching targeted attacks utilize malware to sabotage, damage or halt business operations.[133] Although MSMEs are at greater risk of cyberthreats, only about 60 per cent of countries have or are working to improve cyber awareness among MSMEs and the private and public sector, as shown in Figure 28.

Potential interventions:

A) National cybersecurity strategies

To address cybersecurity holistically across the national digital economy, each country should develop and implement a national cybersecurity strategy (NCS). Through the strategy, governments can define the vision, objectives and priorities relevant to the country, e.g. governance, preparedness, resilience, data protection, and safeguarding critical infrastructure. Countries can develop their NCS by establishing the necessary leadership, and committees; identifying the stakeholders who should be included in the process; evaluating the national cybersecurity landscape and risks; developing a strategy, with corresponding targets, in line with recommendations from the evaluation; and consulting with beneficiaries from across industry, the social sector, and civil society. The NCS should also be aligned with other objectives related to ICT. Once finalized, the strategy should be translated into legislation, actionable policies, roadmaps and initiatives for implementation. In addition, these should be supported by sufficient resources and budget. Implementation of the strategy should be monitored to determine the progress against objectives, measure the efficacy of actions, and identify areas for improvement.

B) Cybersecurity capacity building of MSMEs

MSMEs are at greater risk of falling victim to cybercrimes as they are not always well-equipped to handle them, especially in developing markets. It is important that these enterprises are empowered with adequate knowledge, skills, cyber hygiene and security resources (software, hardware and education) to protect themselves and respond appropriately when exposed to a cyberthreat. PPPs are mechanisms that can help make cybersecurity frameworks, best practices, training materials and programmes more accessible and affordable for MSMEs. In addition, private sector organizations could collaborate with MSMEs to share expertise, experience and skills. Governments can advocate for and incentivize partnerships and collaborations by including or even prioritizing cybersecurity for MSMEs in the NCS and bringing together key stakeholders to engage and commit to action.

Spotlight

To ensure that SMEs are capable of finding and addressing cyberthreats independently, the SMESEC consortium (in partnership with the EU and Switzerland) has developed a “lightweight” cybersecurity framework. The framework provides training tutorials and tools to empower SMEs with cybersecurity capabilities. [135]

Key issue: Unsustainable practices and impact of the digital economy

Connecting the world to ICT has had a significant impact on the sustainability of the planet. Digital technology usage is estimated to account for 3.7 per cent of global greenhouse gas (GHG) emissions.[136] The production and transporting of digital devices can be energy-intensive and heavily dependent on raw materials, contributing further to GHG emissions. Using ICT is heavily reliant on electricity. Although there has been a shift towards renewable energy, approximately 60 per cent of global electricity production is still from fossil fuels.[137] For the ICT industry to comply with the Paris Agreement, GHG emissions need to be reduced by 45 per cent between 2020 and 2030.[138]

As the uptake of digital technology grows, so too does the resultant waste. Waste electrical and electronic equipment (WEEE), also called e-waste, is among the fastest-growing waste stream globally. Between 2014 and 2019, e-waste increased by 9.2 Mt.[139] WEEE poses a threat to human and environmental health if not handled and disposed of appropriately. Yet if it is recycled effectively, a potential value of USD 57 billion or more could be recovered each year from the raw materials, based on figures from 2019.[140] However, as of 2019, only 78 countries had legislations, policies or regulations to address e-waste.[141]

Potential intervention: Integration of sustainability in the digital economy

Sustainability should be central to how the public, private, social, and civil society sectors engage in the digital economy. Policy-makers can enact legislation and regulatory frameworks that mandate and incentivize sustainable practices. Enterprises need to embed sustainability as their way of operating and align it with their business objectives. The adoption of principles like the circular economy, carbon neutrality, and net-zero green software engineering, can guide how businesses approach sustainability. Establishing committees and identifying leaders to champion the sustainability agenda in an organization can help provide strategic guidance to drive progress on targets, initiatives and best practices. A shift from the linear economy of take-make-dispose to one of a circular economy for electronics is key, where ICT equipment is designed with waste management in mind, reuse and repair are encouraged, and discarded equipment is collected and properly recycled. These factors are critical in order to ensure the necessary rise in ICT penetration rates over the long term.

Digital innovations that reduce the environmental footprint of these technologies should be commercialized and scaled across industries. Civil society organizations need to be made aware of the impact of their ICT-related activities on global sustainability. With increased awareness through campaigns, media attention, and transparency from businesses as well as access to more accurate data, individuals should be empowered to make more sustainable decisions. Partnerships involving the public, private and social sectors can help industries to agree on strategies and targets, produce more environmentally responsible innovations, increase demand, and source funding to support a sustainable digital economy.

Spotlight

ITU, UNIDO and other partners are collaborating on a project funded by the Global Environmental Facility (GEF) that aims to bolster regional cooperation in Latin American countries. This has led to the production of a case study on how Costa Rica implemented ITU’s guidelines on “achieving e-waste targets of the Connect 2030 Agenda” and “certification schemes for e-waste recyclers”. Furthermore, ITU has assisted with the creation of the Regional E-waste Monitor for Latin America. [143]

Spotlight

The Coalition for Digital Environmental Sustainability (CODES) is a global, multistakeholder alliance that consists of governments, companies and civil society organizations and is committed to utilizing digital transformation as a positive proponent for sustainability and climate action. CODES has collaborated on the development and advancement of the Action Plan for a Sustainable Planet in the Digital Age, which will determine the key shifts and strategic priorities to drive development environmentally and socially. [144]

Commit to a pledge on our Pledging Platform here. See guidelines on how to make your pledge in Pledging for Universal Meaningful Connectivity and examples of potential P2C pledges here

Footnotes

[122] ITU. (2020). Mapping ICT infrastructure and financial inclusion in Mexico.

[123] World Bank. (2018). UFA2020 Overview: Universal Financial Access by 2020.

[124] UNCTAD. (2021). Digital Economy Report 2021.

[125] Vodafone. (2022). What is M-PESA?.

[126] UNCTAD. (2021). The UNCTAD B2C E-commerce Index 2020: Spotlight on Latin America and the Caribbean.

[127] UNCTAD. (2021). Digital Economy Report 2021.

[128] Statista. (2021). In-depth: B2B e-Commerce 2021.

[129] Statista. (2021). In-depth: B2B e-Commerce 2021.

[130] VC4A. (2022). HeHe Innovation Academy.

[131] Symantec. (2019). Internet Security Threat Report.

[132] Symantec. (2019). Internet Security Threat Report.

[133] Symantec. (2019). Internet Security Threat Report.

[134] ITU. (2021). Global Cybersecurity Index 2020.

[135] SMESEC. (2022). Cybersecurity for Small and Medium-Sized Enterprises.

[136] The Shift Project. (2019). “Lean ICT” – Towards digital sobriety.

[137] Our World in Data. (2020). Share of electricity production from fossil fuels.

[138] ITU. (2020). Press release: ICT industry to reduce greenhouse gas emissions by 45 % by 2030.

[139] Forti, V., Baldé, C.P., Kuehr, R., & Bel, G. (2020). The Global E-waste Monitor 2020: Quantities, flows and the circular economy potential.

[140] Forti, V., Baldé, C.P., Kuehr, R., & Bel, G. (2020). The Global E-waste Monitor 2020: Quantities, flows and the circular economy potential.

[141] Forti, V., Baldé, C.P., Kuehr, R., & Bel, G. (2020). The Global E-waste Monitor 2020: Quantities, flows and the circular economy potential.

[142] Forti, V., Baldé, C.P., Kuehr, R., & Bel, G. (2020). The Global E-waste Monitor 2020: Quantities, flows and the circular economy potential.

[143] ITU. (2022). E-waste: ITU’s work to combat e-waste.

[144] SparkBlue. (2020). Coalition for Digital Environmental Sustainability (CODES).